The origins and history of reverse mortgages reveals a loan product that has evolved dramatically over the last 40 years. The first reverse mortgage loan was written in 1961 by Nelson Haynes of Deering Savings & Loan (Portland, Maine) to Nellie Young, the widow of his high school football coach helping her to stay in her home despite the loss of her husband’s income.

The need for reverse mortgages was further developed in the 1970’s with several private banks offering reverse-mortgage-style loans. These programs gave seniors money from their home but did not afford the protections of today since no FHA insurance had been put in place.

In the early 1980’s the U.S. Senate Special Committee on Aging issued a report stating the need for a standardized reverse mortgage program. Other committees throughout the mid 80’s cited the need for FHA insurance and uniform lending practices. In late 1987 Congress passed the FHA insurance bill that would insure reverse mortgages. On February 5, 1988, President Ronald Reagan signed the FHA Reverse Mortgage bill into law. In 1989 the first FHA-insured HECM was made to Marjorie Mason of Fairway, Kansas by the James B Nutter Co.

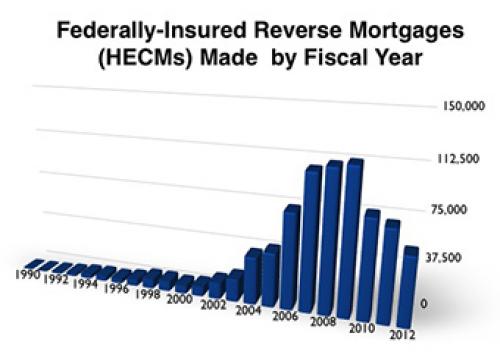

Since 1989 reverse mortgages have grown in popularity, especially in the mid to late 1990’s. Despite economic upheaval and forward mortgage lending issues, reverse mortgages have continued to grow as a safe, government-insured loan allowing seniors to access a portion of the value of their homes while not having to make a monthly mortgage payment.*

* Borrowers must continue to pay property taxes, homeowner’s insurance and other property obligations complying with HUD’s requirements for the loan. Failure to do so may result in foreclosure.